Palette Knife Workshop: Vibrant Skies

Spruill Art Center

404.872.5338

Atlanta, GA

Register

Supply List

Directions

Your Custom Text Here

If you scroll down, there is a nice little feature about my new studio and classes. Join me if you can!

Can we be so bold as to say that this was the best Atlanta Dogwood Festival ever? With three days of perfect weather, a park filled with blooming dogwoods and some of the world's most incredible artists, the 78th annual festival topped all of our expectations. We'd like to take this opportunity to thank the many people who brought this three-day event to life.

Mark your calendars now for the

79th Annual Atlanta Dogwood Festival

in Piedmont Park April 10-12, 2015!

Artist Market ArtistsThe Atlanta Dogwood Festival is the city's oldest fine arts festival, and it is made possible thanks to the hundreds of superb artists who comprise the Artist Market each year. This spring, we welcomed 260 fine artists from all over the country, including many from the Atlanta area. The Artist Market jurors received more than 1,100 entries this year and selected the top artists in a variety of categories. Be sure to check out our Artist Winners who are literally the best of the best!

Corporate Sponsors

After 78 years, the Atlanta Dogwood Festival is still a free event. This would not be possible without the generous support provided by our corporate sponsors. From providing financial support to creating interesting activation onsite, sponsors including:

Kanga

...and many more truly make this festival happen.

Please patronize them and thank them for their support of the arts in our community!Main Stage Live Music Performers

Did you find a favorite new band on the Main Stage this year? We love filling the air with live music all weekend. From performers of rock to country to blues and jazz, the festival appreciates the many musicians who visit the stage each year to play old favorite and introduce audiences to new tunes. You can still find all of the weekend's performers on the festival website!Backyard Barbecue & Brews Participants

This year, we launched a new ticketed event during the festival, Backyard Barbecue & Brews. You might have heard that both days of the BBQ throw-down sold out, and ticket holders were thrilled with the variety of barbecue and craft beer offerings. We would like to give a huge thank you to the restaurants, chefs, wine and spirits companies and breweries who participated in this event and helped us make it such a success!

International Stage Performers and Cultural Exchange Partners

The Atlanta Dogwood Festival is proud to present the award-winning International Stage & Village each year. Held on the Lake Clara Meer Dock, the International Stage welcomes hundreds of performers representing countries around the world. Nearby, international organizations and consulates set up Cultural Exchange Pavilions where visitors can learn about the culture of different countries. This year, we had participants from Canada, France, Germany, Hungary and Taiwan. Thanks to these performers and organizations for bringing the world to the festival each year.

Media Partners

How did you find out about the Atlanta Dogwood Festival? Perhaps it was from one of our media partners! Each year, the festival works with a range of tv, radio, print and online media partners who generously donate their airtime and space to help us spread the word about the festival and its many offerings.

Vendors, Staff, Volunteers and Board

Putting on such a large festival and making sure it runs smoothly is no easy task! It requires the help of many, many volunteers throughout the weekend. The festival also has an amazing working Board of Directors who are hands-on, assisting in every area of the production. Throughout the year, the festival staff members work hard planning each of the aspects brought to the park in the spring, and support from TRRU Event Management, Premier Events, MixIt Marketing, LiveThrive, Launch Atlanta, the Atlanta High School Art Exhibition and Frey Art & Design brings it all together!

Thanks to everyone who helped make the 78th, the best Atlanta Dogwood Festival in history!

Take Art Classes from Festival Artist

"Enjoy the Journey" 36 x 36 oil on canvas. Dawn Kinney MartinIsn't it time to get painting? Atlanta Dogwood Festival artist Dawn Kinney Martin is excited to announce a series of classes at her new studio. Several weekend workshops and a Tuesday night painting studio class are available beginning in July. This fall, she will add plein air workshops. We are thrilled for Dawn as she begins this new journey and hope that Dogwood Festival art lovers will become art creators.

Retrospective of AHSAE Best of Show Winners

This summer, revisit the best of the Atlanta High School Art Exhibition (AHSAE) at Oglethorpe University Museum of Art! "Retrospective of AHSAE Best of Show Winners" will be on view June 28-August 31 in the Hallway Gallery.

Each year, the Atlanta Dogwood Festival sponsors the AHSAE, an art competition for talented young artists from throughout Atlanta and Georgia. This vital exhibition and competition provides winners with nearly $40,000 in scholarships and prizes and has received national recognition for its impact on young artists. AHSAE helps to fill a growing gap in creative opportunities for youth while highlighting the breadth and variety of young artistic talent.

Our mailing address is:Atlanta Dogwood Festival887 West Marietta Street,NW Studio S-105Atlanta, GA 30318Phone: 404-817-6642Fax: 404-817-9508

Here is an interesting article I can across this morning and thought I would share it. As artists we are always trying to find a balance between creating and the business side. Michael Soltis shares his experience as an artists and a gallery owner.

Artsy Shark

ArtsySharkFeed

Guest blogger Michael Soltis, an artist who has also owned a gallery, shares his insights and experience. This article is reprinted from the current special issue of Mixed Media Art Magazine.

Artist Michael Soltis with his work.Being a gallery owner was rewarding, exciting, challenging and fulfilled my desire for creativity in ways that nothing else in my life ever has. I loved that my time, energy and resources were being used to promote art and artists and that my contribution to the world was one in which creativity and beauty was shared.

However, I learned that making money in the art business is very difficult. Most people who came into my gallery would say wonderful things about the work, but the percentage of art buyers was very low.

Not only do the buyers need to find a piece that they like but it also has to be the right size and dimensions and most importantly, they have to have a place to put it. And art buyers buy lots of art – so they usually don't. So you need to reach more people by marketing your business.

You have to spend money on advertising and spend lots of time out in the community, attending events, meeting with people and becoming a well-known (and well-liked) art professional. The ongoing operational costs are massive and if you have employees the costs skyrocket. Art fairs are becoming an industry standard to reach collectors these days and the fees and costs to get you and the art there is not even within reach of many galleries. So I found it very difficult to survive and I have immense respect and admiration for those who do.

Artwork at Stark + Kent Gallery in Palm Springs, CAGallery owners are running a business and they need art that sells in order to remain viable. So if they like an artist's work and it fits in well with their roster and they think it will sell, they will want it in their gallery.

If they like the work, gallery owners will want artists who are professional, who are constantly creating, constantly learning, constantly working and who have a clear vision. They also want an artist who has several pieces ready to ship that are part of a consistent and cohesive body of work that represents who the artist is. So while it's great to explore different ideas and techniques and I would never discourage that, when a gallerist wants to see your work, make sure you present them with pieces that are part of collection and/or that are in a particular style.

I think the gallery owners that ended up representing me decided to do so because they liked my work and thought it was marketable but also because I was pleasant, professional, and didn't push myself on them. I presented a singular vision for what I was trying to accomplish. They noticed that I was someone who took my art career seriously, would do what I said I would do, was kind, polite and had a good understanding of their business, and realistic expectations.

As a gallery owner, these are the types of artists I chose, and I typically found them because they were showing their work and it was available for me to find. Getting noticed by a gallery owner requires that you look for as many opportunities as you can to get your work out there.

But always be aware of the environment and context in which your art is shown; it will affect people's perception. Each artist needs to decide what that means for themselves, but if it doesn't feel right and you don't think it puts your work in the best light, don't do it. It is absolutely crucial to have a good website and online presence (Facebook, Twitter, Instagram, etc.) Be simple, clean, consistent and professional. You must promote yourself this way – these are invaluable tools and they create a perception.

Michael Soltis art studioI have to add that while galleries can generate some sales, I have become incredibly inspired by artists who are able to build their business on their own. I have a good friend who has been painting for over 12 years. She has been approached by several galleries, but has opted to continue to do her own thing. She sets her pricing, she offers reductions when it makes sense, chooses certain design/home decor stores that hold a few pieces and works with an art consultant that represents her to collectors and designers. For the most part, she pockets 100% of her sales and she makes over $100,000 a year out of her studio.

This didn't happen overnight and she puts in the work – the work of creating and the work of selling. I am really encouraged to see that it is possible to do it on your own. That's where I would put my focus if I was a newer artist or had a desire to make art a full time job. If you are working hard, getting better and putting the work out there, you will get noticed. But you must be patient.

I was actually with a large online gallery for a year and my work was featured on a site that has daily online art auctions. I didn't find it effective for my work. Online shopping is a huge business, but I question it's validity for selling original art. For lower priced works or reproductions, absolutely. But if you're selling a piece of art for $1,000 – $5,000, unless the buyer is already familiar with the artist, or really trusts the curator, no matter how many pictures you take in different angles, most buyers are still going to want to see it in person.

I know of a few galleries who have opted not to have a brick and mortar space and instead spend their money on art fairs and working directly with designers and art consultants, and the online component supports that. In my opinion, that is a good option and if I were to open another gallery or be represented by another gallery, I would really consider this.

The artist Michael SoltisMy final thought: I have been an actor and an artist for over 13 years. I've had many successes and many failures, and my psyche bears the scars of countless rejection. But every time I go to another audition or face another blank canvas I am convinced that it is my tenacity that will win out. My desire has always been and will continue to be that I am able to support myself and my family through my art exclusively. I know this is a rarity in today's world but I will never give up. Ever.

If that is your desire, I hope you don't either. Whether your work is in a gallery or online or in your studio or at an art fair or hanging in a coffee shop, keep creating it. Keep sharing it. Keep getting better. Because it's just a matter of time. Those who stick to it, succeed. It is possible. Our dreams are possible.

Happy painting - List of Upcoming Classes

|

| ||||||||||||||||||||||||||||||

SPLASH WEEK!a gathering of artists & all creative folks

Pack up the tools of your creativityand head to Elizabeth Cityfor the sixth annualSPLASH!A time especially for you to dive into yourtalented spiritin the creative world of Elizabeth City, NC.

Wednesday, June 4, 2014through Sunday, June 8, 2014Come when you can and stay as long as you can.

You’ll spend your days immersed in your own creative endeavor at your own special spot...the banks of the Pasquotank,the bow of a boat,the meadow of a farmer’s field,a private garden,an old shipyard,a swamp filled with Cypress trees,a studio in a historic downtown building,or in our fabulous Arts of the Albemarle.

And...when you’re not indulging in creativity,we invite you torest on a wide front porch,drink a latte,share art talks with other like-minded people,orpaddle the river in a kayak,peddle the back roads on your bike,join a drum circle.

OPPORTUNITIES TO MEET & MINGLE

Tuesday nightMariners’ Wharf Film Festivalon the waterfront - 8:30 p.m.Bring a chair

Wednesday nightyou’ll be our guest at aLow Country Boilwith drum circle & painted chair auctionon the banks of the river

Thursday nightA Science of Beer Party,a fundraiser for Port Discoverfeaturing 6 microbreweries & foodorenjoy a downtown piano bar provided by our local talent

Friday all dayElizabeth City Art Walkwhere you can show and sell your work.

Begin the day on Saturday at ourRiverside Marketand end it withTaste of the Albemarle,the 10th annual main street party/fundraiserfor the Arts Council,featuring food from 25 restaurants &one of the best bands around:

Out ’n the ColdLodging - Accommodations are being offered in the gracious homes of Elizabeth City for the first 30 artists requesting it, or if you prefer, our fabulous B&Bs and select hotels are offering special rates for your time in Elizabeth City. Check in – Begins at 9:00 a.m. on Wednesday, June 4 at our headquarters, Arts of the Albemarle located at 516 W. Main Street.Registration – Complete the attached registration form and return it to Carolyn Peel atjandcpeel@aol.com. Call Carolyn if you have questions at 252-335-7692.

VISUAL ARTISTS ShareThis Download our expense checklist for visual artists PDF Version Download our expense checklist for visual artists Excel Worksheet Version Download our income worksheet for visual artists PDF Version Download our income worksheet for visual artists Excel Worksheet Version Download our 12 month expense worksheet for visual artists Excel Worksheet Version Taxation & tax deductions for the self-employed visual artist By Peter Jason Riley, CPA Artists and taxes don’t seem to mix very well. Taxes and administrating the business of art are often last on the list of concerns for the visual artist. The artistic temperament simply does not interface well with the exacting rule-filled world of federal and state taxation. Artists tend to avoid the whole matter and consequently leave themselves vulnerable to bad advice. The secret to overcoming this phobia is to develop an understanding of the mechanisms of the tax code and some simple, effective ways of complying with this onerous task. I often use the analogy that you may not need to know how to fix your car but it is helpful to know how it basically works. In so doing you will pay less in taxes and you will be less likely to fall prey to erroneous tax information and disreputable or ill-informed advisors. A majority of visual artists are considered “self-employed” in regards to filing their taxes. In a legal and taxpaying sense this means that your “business” as an artist and you as an individual taxpayer are one and the same. There is no legal separation, such as one would have in a corporation, partnership, LLC or other legal entity. The artist usually files a “Schedule C” as part of their regular 1040 income tax form, which is where you report your art income and expenses. The artist may file a form 8829 for the home office (studio) deduction and will also be required to pay self-employment tax (Schedule SE) on your net income (profit) as well as federal income tax. All these forms are part of the year-end 1040 income tax filing. As a self-employed artist, you will usually be required to pay estimated quarterly taxes using Form 1040-ES if your Federal tax liability is over $1,000 for the year. The goal is first and foremost to lower your taxes! The artist has a number of tax deductions that are unique. In the balance of this article I will try to break them down to their component parts to make the issues understandable. For the IRS all deductible business expenses are those that are:

Is Being an Artist a Business? The first hurdle visual artists often have is the question regarding whether their “art” is indeed a business for tax purposes. The heart of this matter is whether the I. R. S. sees the endeavor as a real “business” or as a “hobby.” Because the artist’s ventures often (sadly) yield losses, the question then becomes when the tax code determines an enterprise to be a true business as opposed to a hobby. Here's how you may be affected by these so-called “hobby” rules. Although you must claim the full amount of income you earn from your hobby, hobby-related expenses are generally deductible only to the extent of income produced by the activity. So if you don't generate any income from your hobby, you can't claim any deductions. What's more, even those hobby expenses which can be deducted are subject to an additional limitation: they are considered miscellaneous itemized deductions on Schedule A, which are deductible only to the extent that they exceed two percent of your adjusted gross income. In contrast, if your activity can be classified as a bona fide business, you may be able to deduct the full amount of all your expenses by filing a Schedule C. In short, a hobby loss won't cut your overall tax bill because the tax law stipulates that you can't use a hobby loss to offset other income. Converting your hobby into a bona fide business means you can deduct a net loss from other income you earn, such as wages and salaries. How does the IRS determine whether your activity is a hobby or a for-profit business? The Internal Revenue Service publications discuss these nine criteria:

Income

Income for the artist includes amounts paid to the artist for their artwork. Income for the artist also includes prizes, awards, fellowships, and endowments received. There is also the concept of “taxable income other than cash.” This includes trades of art between artist and other individuals. For example: an artist agrees to “sell” a painting to another artist by exchanging artwork. The painting that the first artist gives up “costs” $75 (the cost of paint, canvas, and framing). The artwork received has a market value or price of $1,000. The first artist will have a taxable income from this transaction of $925 ($1,000 less $75). In other words the artist received something worth $1,000 but only paid $75.

Inventory

Inventory is often problematic for many artists; I often get blank stares when I ask the question at tax time. The inquiry concerns the artists cost at year end of the artwork that has not yet been sold, this is the artist’s inventory. Not to get too technical, but the calculation of inventory is primary in arriving at “cost of goods sold.” In other words, my direct materials deduction for tax purposes is (1) the direct cost of all material used in the production of finished art work; materials, framing, printing, etc LESS (2) the finished artwork held at the end of the year (ending inventory). Some artists (being cash based taxpayers) can ignore this process altogether because the direct product costs are relatively minor (a potter comes to mind), but for most fine artists, photographers, etc. the cost of framing alone can be sizable enough to require addressing ending inventory. On the tax return the calculation looks something like this:

In this example the artist started the year with $5K of value (stretchers, printing, materials costs, framing, prints, etc) in “unsold” art work from prior years. During the year she purchased $3K of materials, had $2K of printing costs and spent $6K in framing so that during the year she spent $11K producing new finished art work. The $11K added to the $5K beginning number to yield $16K of direct costs in finished art for the year. Finally at year end she had $5,500 (in cost) of unsold art work, this was her ending inventory. According to this example her deductable direct cost of art work sold during the year is $10,500. Since you don’t really want to be an accountant (!), the key thing the artist has to be aware of is that they need to take an inventory at year-end. This means coming up with a (usually) estimated cost of art work unsold at year end (keep in mind that this may include work from earlier years). This is art work held everywhere; in galleries, the home as well as in the studio. The artist should first make an inventory list of titles and then estimate to the best of his or her abilities the direct costs represented by each work. Keep in mind that the selling price is NOT relevant, just the actual cost of materials, framing, etc.

Travel & Meals

The artist is allowed to deduct all expenses associated with overnight business travel. These include meals (only 50% deductible), hotel & lodging, reasonable tips, dry-cleaning, phone calls home, etc. Overnight travel is roughly defined by the IRS as travel that is far enough away from home so as to make it inconvenient to return home at night. Travel could include expenses related to gallery visits, openings of shows, delivering artwork, art fairs, etc. and will include many of the expenditures made on such trips. The other question often asked is the travel deduction for mixed vacation/business travel. As long as the trip is primarily business then deductibility will be maintained. For example, what if the artist has a five-day trip to NYC for a gallery opening and outdoor art fair that includes a two-day stopover in Philadelphia on the way home to visit a friend. In this case the entire NYC trip would be deductible but the expenses related to the Philadelphia stopover, which was personal would not be. Since maintaining individual meal receipts is inconvenient, consider using the IRS “meal allowance” for deducting meals when traveling. This “meal allowance” (adjusted annually by the IRS) ranges from $46 for “low cost” localities and up to $71 per day for “high cost” localities depending on the city or town. In practice this means that receipts for meals are not required as long as the travel itself can be substantiated. This “allowance” includes all three meals and incidental expenses for the day. Travel for spouses or dependents are not allowed unless they are employees of the art business.Meals are deductible (remember, only 50%) as part of the overnight travel and they are also allowed as a separate (non-travel) deduction when they meet the criteria of “ordinary,” “necessary” and business related. This means that the meal must include direct business discussions. This can mean lunch or dinner meetings with agents, fellow artists, gallery owners, etc. If a direct business purpose is clearly documented then the deduction is allowed. These meals could include talks on potential gallery showings, museum exhibits, future sales, Website design or setup, and meetings with lawyers or accountants. The best place to keep records for these expenses is in an appointment book. Log into your book who was present, and briefly the nature and substance of the discussion. I often suggest that you keep a copy of the person’s business card as further substantiation.

Automobile & Vehicle Expenses

The use of an automobile can be one of the most common and largest deductions for the artist. The automobile use expense can be taken in two ways. The first method is by using the IRS “standard mileage allowance.” In 2013, this annually defined allowance is 56.5 cents a mile (56 cents for 2014). To take this deduction you do not need receipts, only records that show the distances driven and the business purpose of the trips. These would include travel to galleries and museums; trips to the art supply store, classes, etc. The best tool for tracking and calculating this expense is your appointment book or calendar. If your calendar has a record of business travel it can be used as a tool to estimate your mileage deduction (odometer readings are appreciated by IRS but NOT required). The second method is to write off direct expenses. In this method you actually depreciate the cost of the vehicle (over 5 years) and then tally up gas slips, repairs, insurance, etc and use that amount as a basis for your expense. This method requires more work and organization. If you were writing off a cube van or other larger vehicle, the second method would be preferred. In my practice I often find the mileage allowance method generally yields the highest deduction for straight automobile use. In any case, the IRS allows the taxpayer to calculate the best method year by year and take the one that yields the highest deduction (within limits).

Equipment

Equipment purchased is generally “depreciated” and written off over 5 or 7 years on Form 4562. Depreciation is a technique for expensing or writing off purchases that have a useful life of greater than one (1) year. In other words, a kiln or printing press is intrinsically different in nature than clay, a tube of paint, brushs or photographic chemicals. Supplies such as inks, film, canvas, welding material, etc. will be written off (or deducted) in the year of purchase. Most art equipment including computers is written off in 5 to 7 years; these “depreciable lives” are defined in the IRS code. The main tax strategy when it comes to depreciation is the use of what is often called “the section 179 election.” The IRS allows taxpayers to “expense” up to $500K in 2013 and it drops to $25K in 2014 unless changed by legislation. In this case the potter is allowed to write-off his/her $5,000 kiln in one year rather than wait seven years to do it, or a photographer could write-off digital cameras on other technology in the year purchased. Remember this “section 179 expensing election” only accelerates the deduction into one year. Either way, the artist is able to write-off (depreciate) the full cost of the purchase.

The Home Studio

The home studio (office) has been a contentious subject in my profession for a number of years. With recent legislation, the home office has clearly returned to its rightful place as an allowable deduction for most artists. If you use a room (or rooms) in your home exclusively as your studio, you will probably qualify for the home office deduction. The use of the room can be as a studio, storage area for equipment and art, record keeping for the business, marketing, etc. The home office is a fairly straightforward deduction to calculate on form 8829. It simply utilizes a formula based on the square footage of the business portion (the home studio) of your home vs. the total square footage of the house or apartment and then applies that percentage to all associated costs. The costs could include rent, mortgage interest, real estate taxes, condo fees, utilities, insurance, repairs, etc. Other rules that come into play here include the “exclusive use” requirement. This rule states that the home office must be used only for the business – no “mixed use” allowed. In other words the studio cannot be a part of a larger room such as the living room unless the business part is partitioned off in some way. The home office can be a powerful write-off in that it allows the artist to deduct a part of what were non-deductible personal expenses. Look into the new "Simplified Method" beginning in 2013.

Finally…

Remember that this outline is not intended to be the whole story. The Federal Tax Code is very complicated and your specific applications should be reviewed with a tax professional before filing your taxes. The visual artist is unique in the world of taxes. When you are shopping for a tax preparer please make sure they have some experience in taxation for artists. Organizing your numbers using our on-line worksheets (and this article) will make the process easier, cheaper and will help you maximize your deductions. Ask your preparer about other tax saving strategies for self-employed individuals such as retirement plans, health insurance and the timing of deductions.

Peter Jason Riley, CPA is the President of the firm

Riley & Associates, P.C. located in Newburyport, Massachusetts. He is also the author of the newly revised book “New Tax Guide for Writers, Artists, Performers, & Other Creative People” published by Focus Publishing. You can contact him via e-mail at peter@cpa-services.com or visit the firms award winning Website dedicated to people working in the arts @ www.artstaxinfo.com.© Peter Jason Riley, CPA © Copyright 2001-2014 Riley & Associates, P.C. 978.463.9350 All Rights ReservedDisclaimer Site Designed and Hosted by NetCasters, Inc. 978.887.2100 |

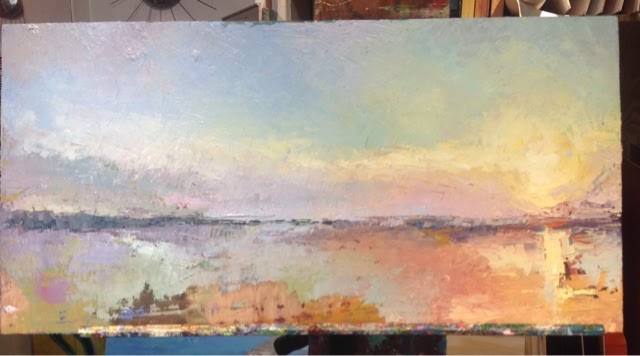

Update - here is the finished painting. I am happy with the results, but I know I still have a lot to learn! Excited to be working on a new direction with my painting.

"Goin'a be a Great Day!" 12 x 24 oil on canvas palette knife painting

I started this one in Tuesday nights class. I am curious to see if I can capture the range of color you see along the coast, but not paint it as bright as an Easter egg! I really want to stay true to the vaules on this one and capture that diffused light.

I like the direction the sky is heading. So, let's see if I can keep it up when I start working on the foreground. Boat docks are coming soon.

Happy painting!

Upcoming Classes

May 3 Color Confidence 1 10 - 3:00

May 10 Palette Knife workshop; Reflections on water

May 30th- June 1 Weekend Painting Retreat

Summer Quarter

June 28 Color Confidence1 10 - 3:00

July 19 Palette Knife Workshop vibrate skies 10 - 3:00

July 26 Palette Knife Workshop trees 10 - 3:00

See more paintings at

My art now available to purchase online click

to go to my secure market.

| |||||||||||||||||||||||||||